Credit Score & Decisioning Engine

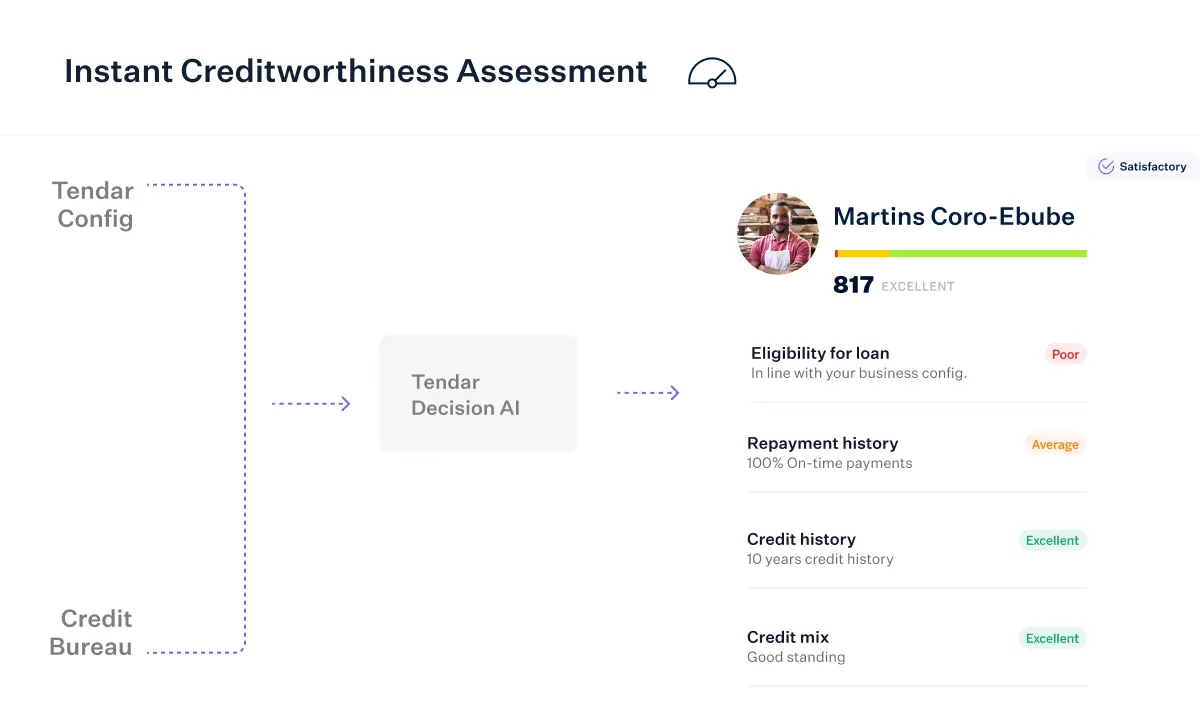

Instant Creditworthiness Assessment

We’re your ally in navigating the complexities of lending. From advanced credit insights to automated processes, we simplify your lending journey.

Contact sales

Trusted By

All your lending needs covered, all in one place

Experience easy integration and efficient operations with Tendar’s intuitive platform. We empower you to focus on what matters most- serving your customers, while we handle the technicalities of it all.

Contact sales

Borrower will pay ₦39,750.00 on 7th of every month

We know how hard the lending business can be, but with our all-in-one credit engine, you and your customers are covered.

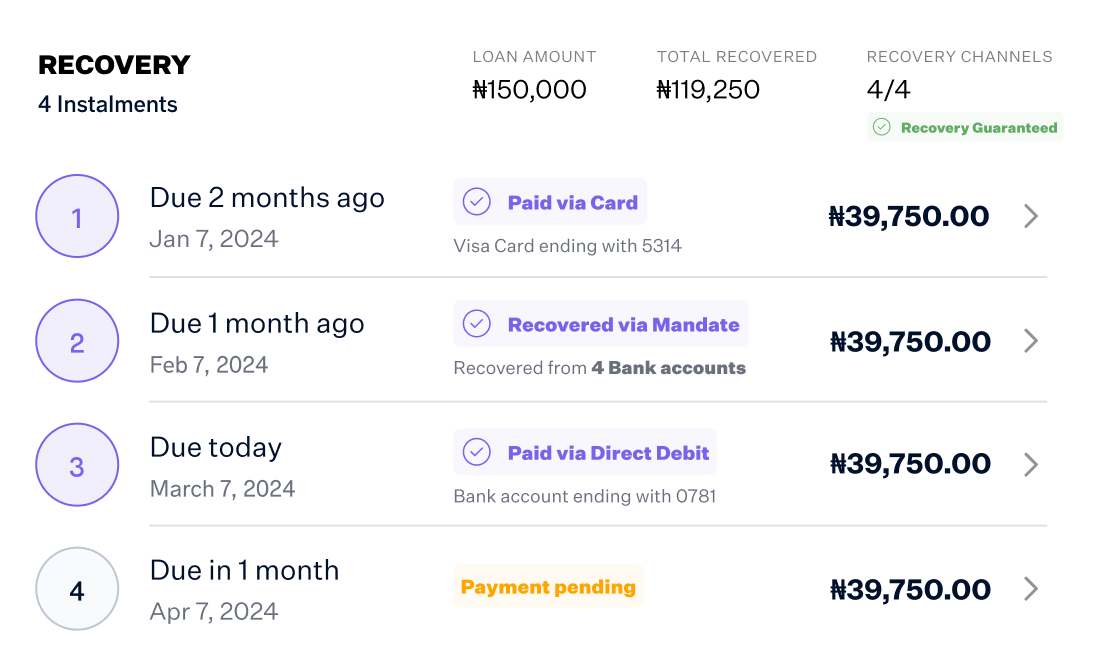

Get StartedStay on track with Tendar's Automated Repayment System. We automatically deduct payments on the due date and send reminders to ensure your repayments are always timely.

Efficient recovery

Direct Debit feature

Customised approach

Secure Transactions

Enhanced Security

Transparency

Tendar lets you customise our credit scoring to match your lending criteria and business model, ensuring accurate decisions aligned with your business goals and users.

creditworthiness assessment

Growth handling capability

Effective Risk management

adherence to standards

Adaptable Market Flexibility

Real-time Insights

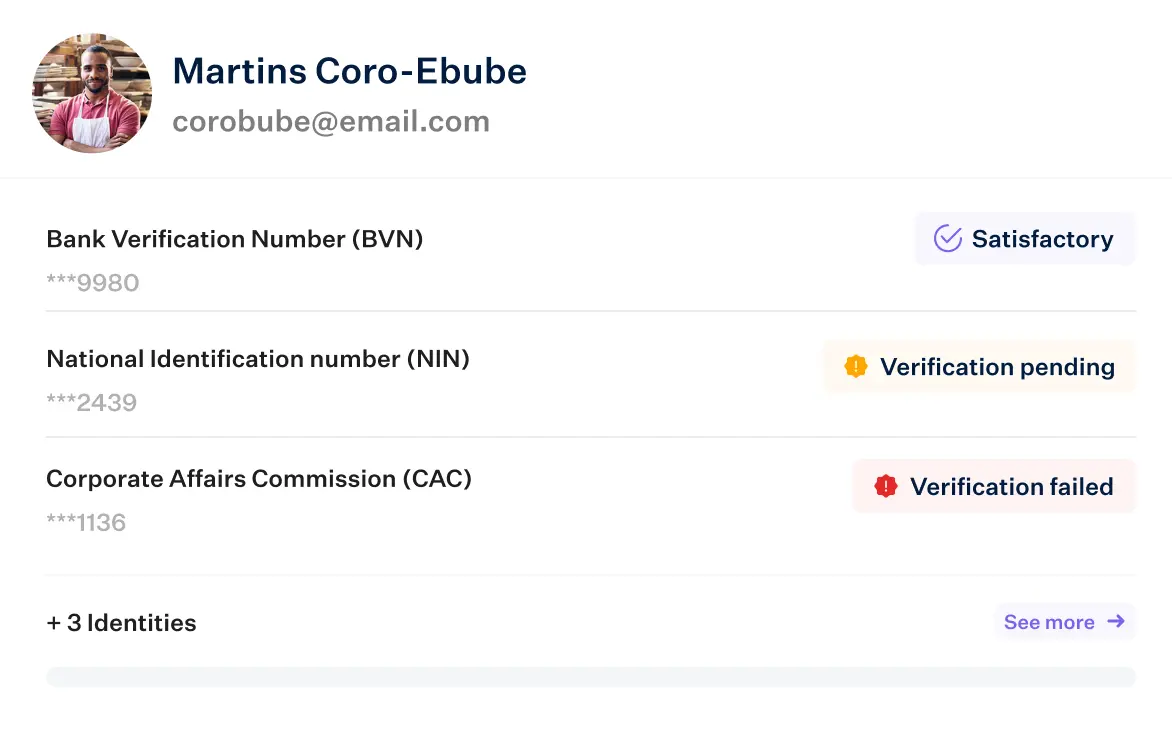

We prioritise security and compliance for your loan business, ensuring accurate verification to mitigate risks and adhere to regulatory standards.

Onboarding

Effortless Integration

Real-time Validation

Secure Transactions

Enhanced Security

Flexibility

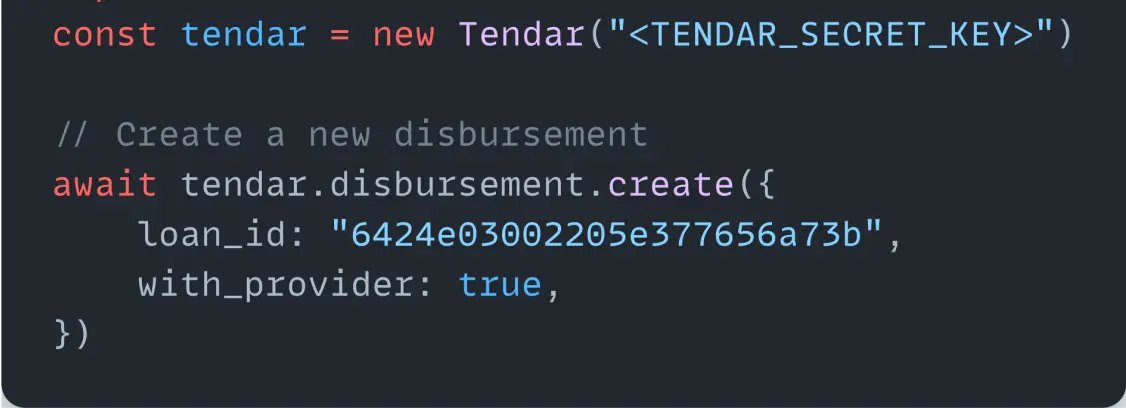

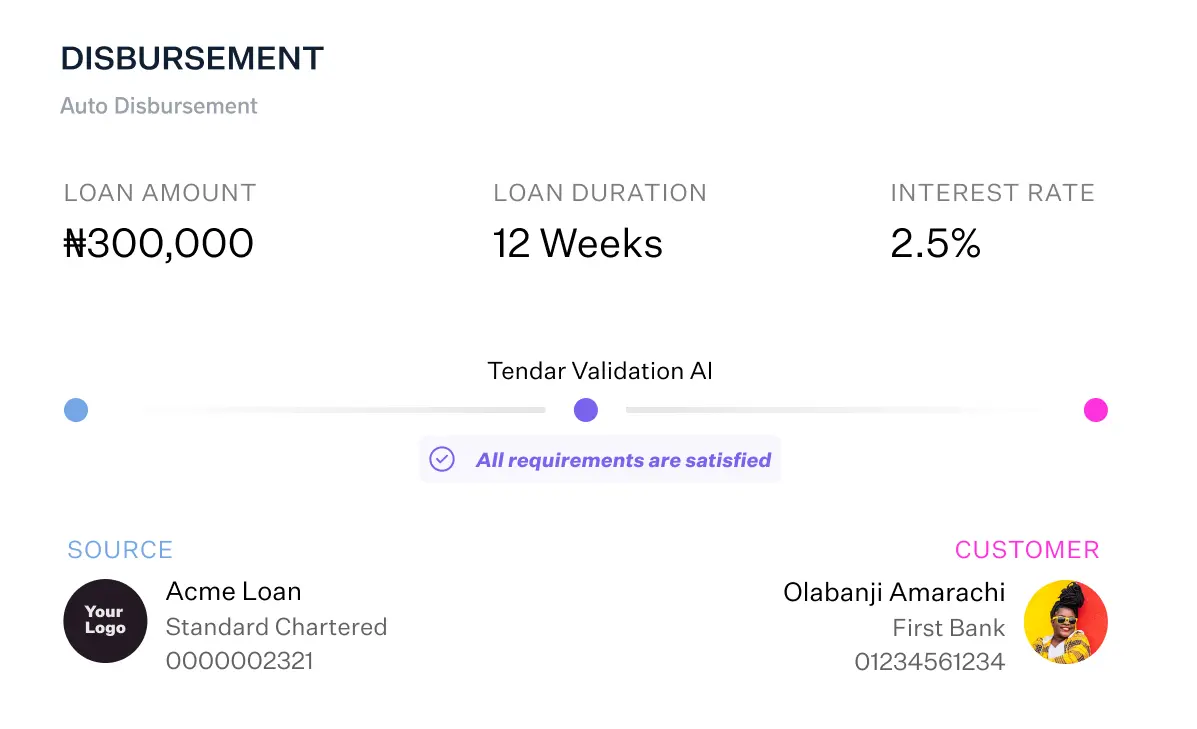

Funds are transferred seamlessly to borrowers' accounts, ensuring timely delivery without the hassle of manual intervention.

On-time fund transfer

Effortless Integration

Compliance assurance

Secure Transactions

Precision assurance

Settings Flexibility

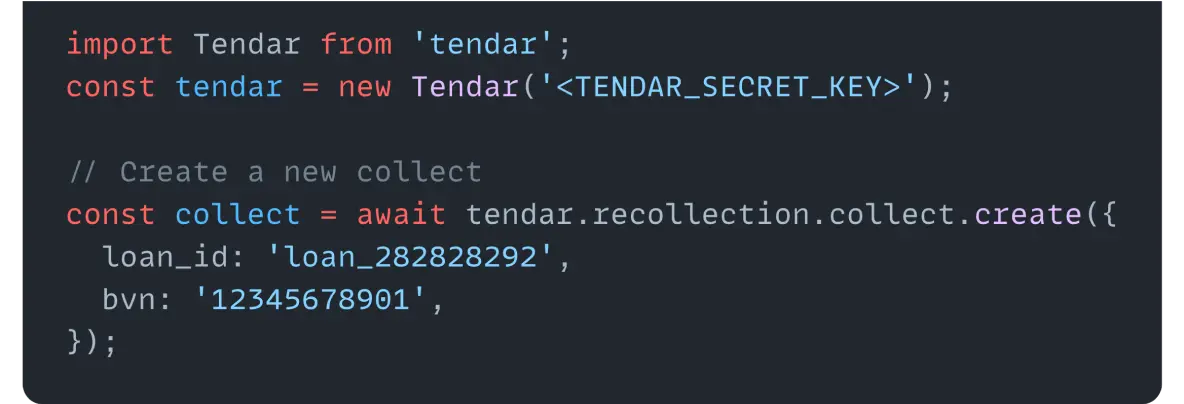

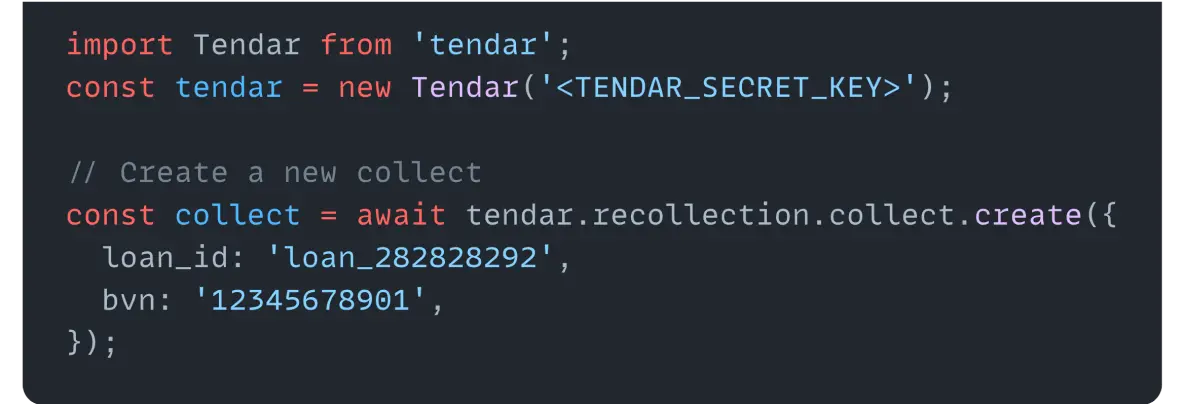

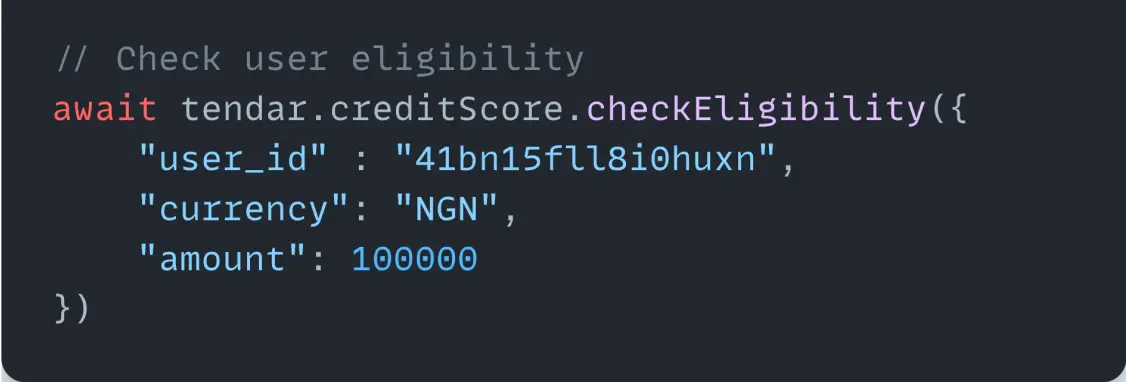

We pride ourselves on being developer-friendly, offering adaptable lending building blocks tailored for developers.

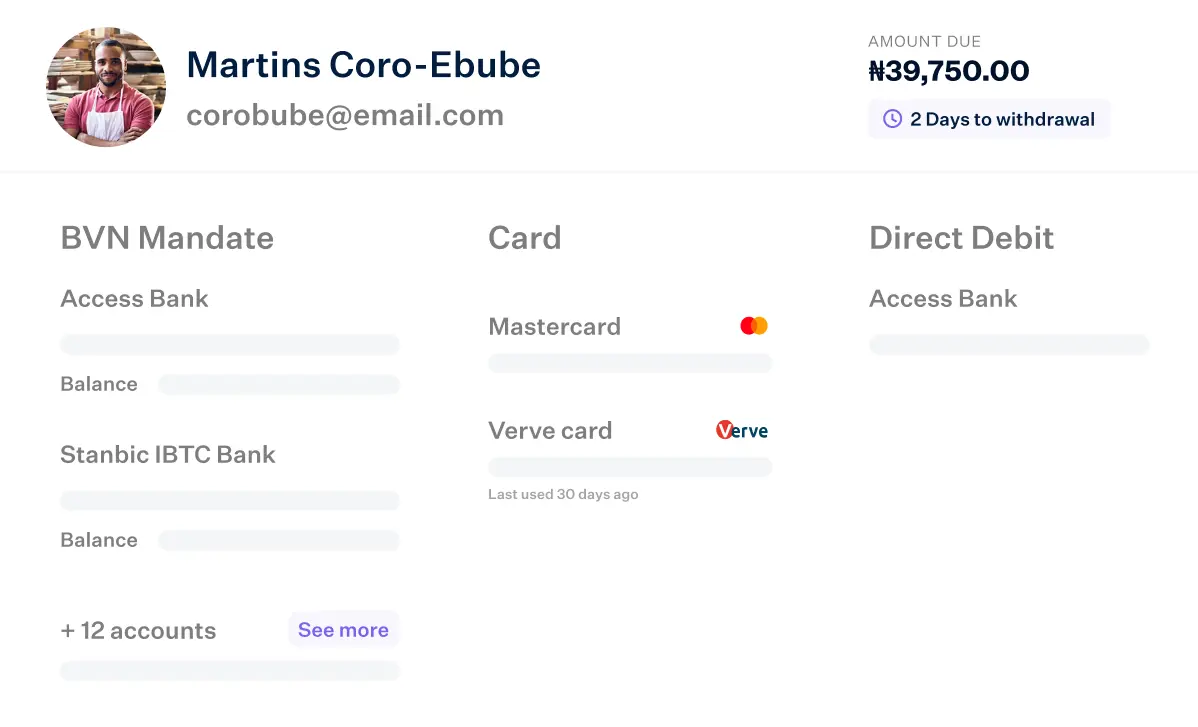

Quickly retrieve and verify customer identities

Implement facial recognition to confirm customer identity and liveliness

With a focus on simplicity and functionality, we provide the tools needed for lending businesses without the extra baggage.

Sign UpIntegrate BNPL option into your platforms, including websites and mobile applications easily.

Accelerate your lending operations and scale with ease with our low-code platform.

Easily manage your inventory with our custom merchant BNPL web and mobile application.

Tendar is your all-in-one loan management software designed to simplify lending for businesses of all sizes. Whether you need KYC verification, AI-powered credit scoring, loan disbursement, or recollection services, Tendar helps you build and launch seamless lending solutions in just a matter of days.

Tendar is designed for banks and other financial institutions, startups, SMEs, fintech, and real estate companies who are looking to digitize and automate their traditional lending processes to improve their operations. Startups especially benefit from our low-code mobile and web applications that help them go to market faster.

We take security and compliance seriously. Tendar’s KYC (Know Your Customer) process is quick, accurate, and reliable. It ensures real-time identity verification, protecting you and your business from fraud while meeting regulatory requirements.

Tendar's AI-powered credit scoring engine provides lenders with detailed credit reports to determine customers credit eligibility using advanced algorithms and multiple data points, including user behaviour and financial history, to provide accurate credit scores.