Merchant Management

Drive operational efficiency and elevate merchant satisfaction with our advanced tools designed to seamlessly oversee and monitor merchant activities.

BNPL

Increase sales and average order values with Tendar's BNPL service. Receive full payment upfront while we manage the installment collections. Enjoy seamless, secure transactions that keep your customers happy and your cash flow steady.

Contact Sales

Transform your debt recovery process with our advanced technology, enabling seamless access to debtors, automated workflows, and streamlined collection operations.

Drive operational efficiency and elevate merchant satisfaction with our advanced tools designed to seamlessly oversee and monitor merchant activities.

Enhance wallet transactions with efficient processes to approve or reject withdrawal requests, ensuring secure and prompt fund transfers.

Empower your business with advanced analytics to comprehend merchant and customer behaviour, optimizing service delivery and surpassing expectations.

Integrate our next-gen credit engine into your product without any hiccups. Save time, cut costs, and launch solutions your customers will love.

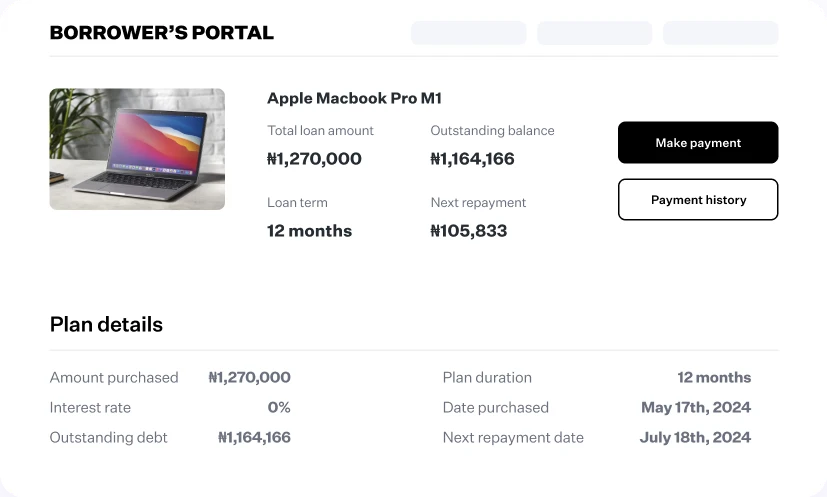

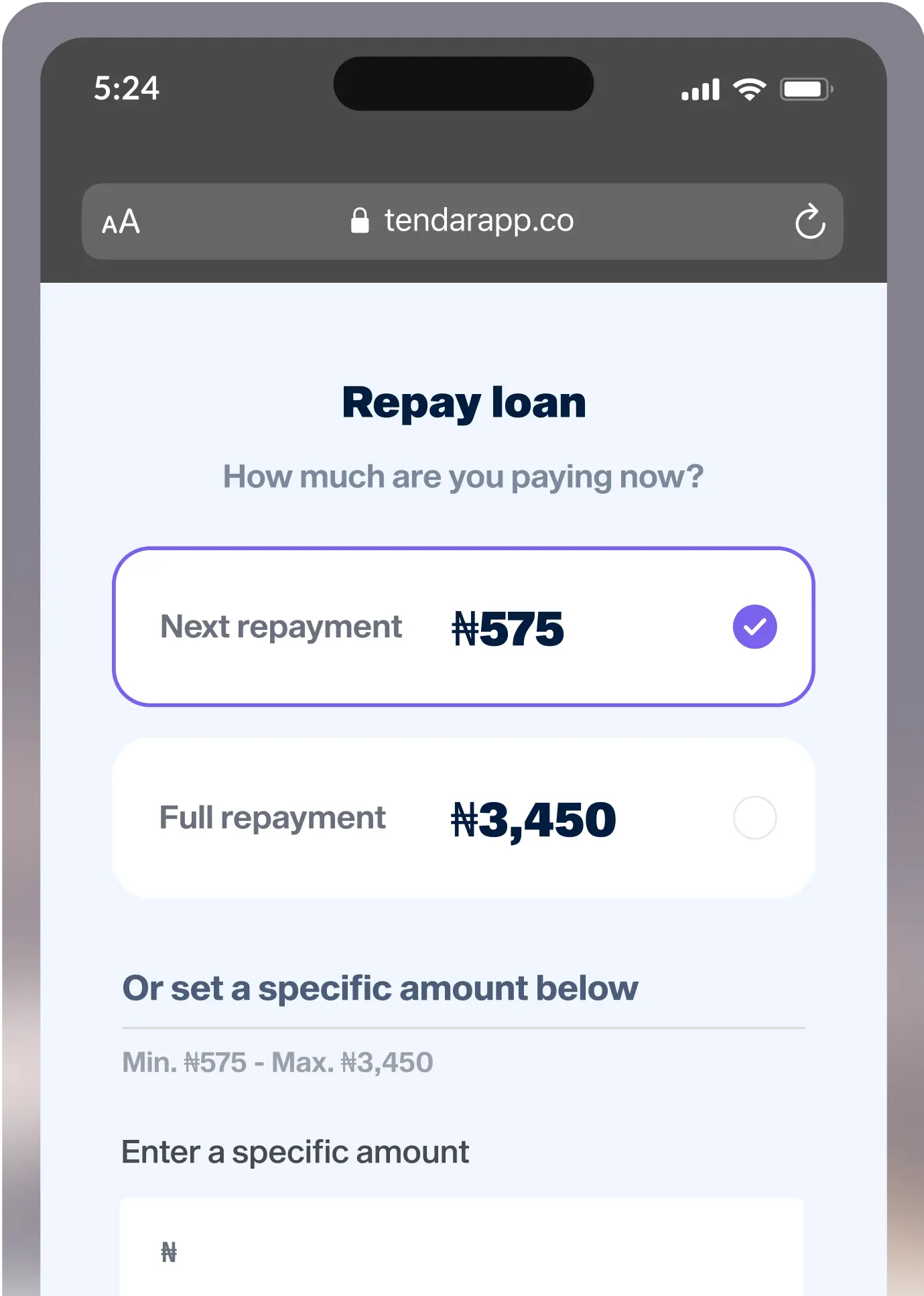

Get StartedExperience a smooth transition to our Borrower Portal via our app, where customers can conveniently access installment details and make payment, all from a single, user-friendly interface.

Keep track of all your applications in one easy-to-use dashboard. This makes it simple to manage your installment plans and stay on top of your finances.

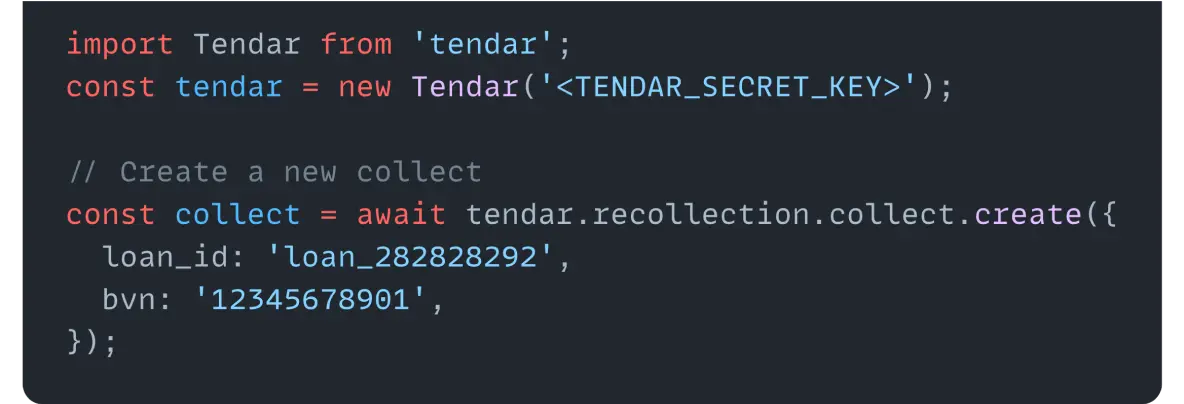

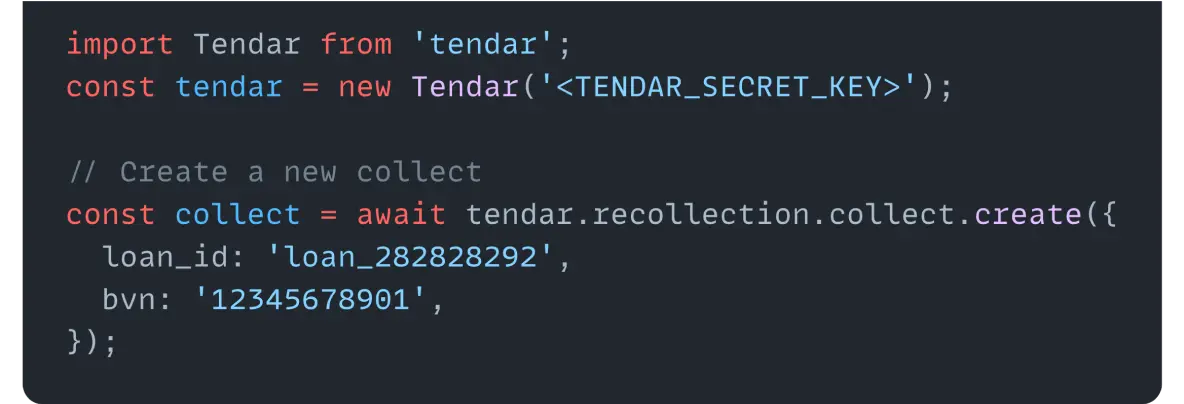

We pride ourselves on being developer-friendly, offering adaptable lending building blocks tailored for developers.

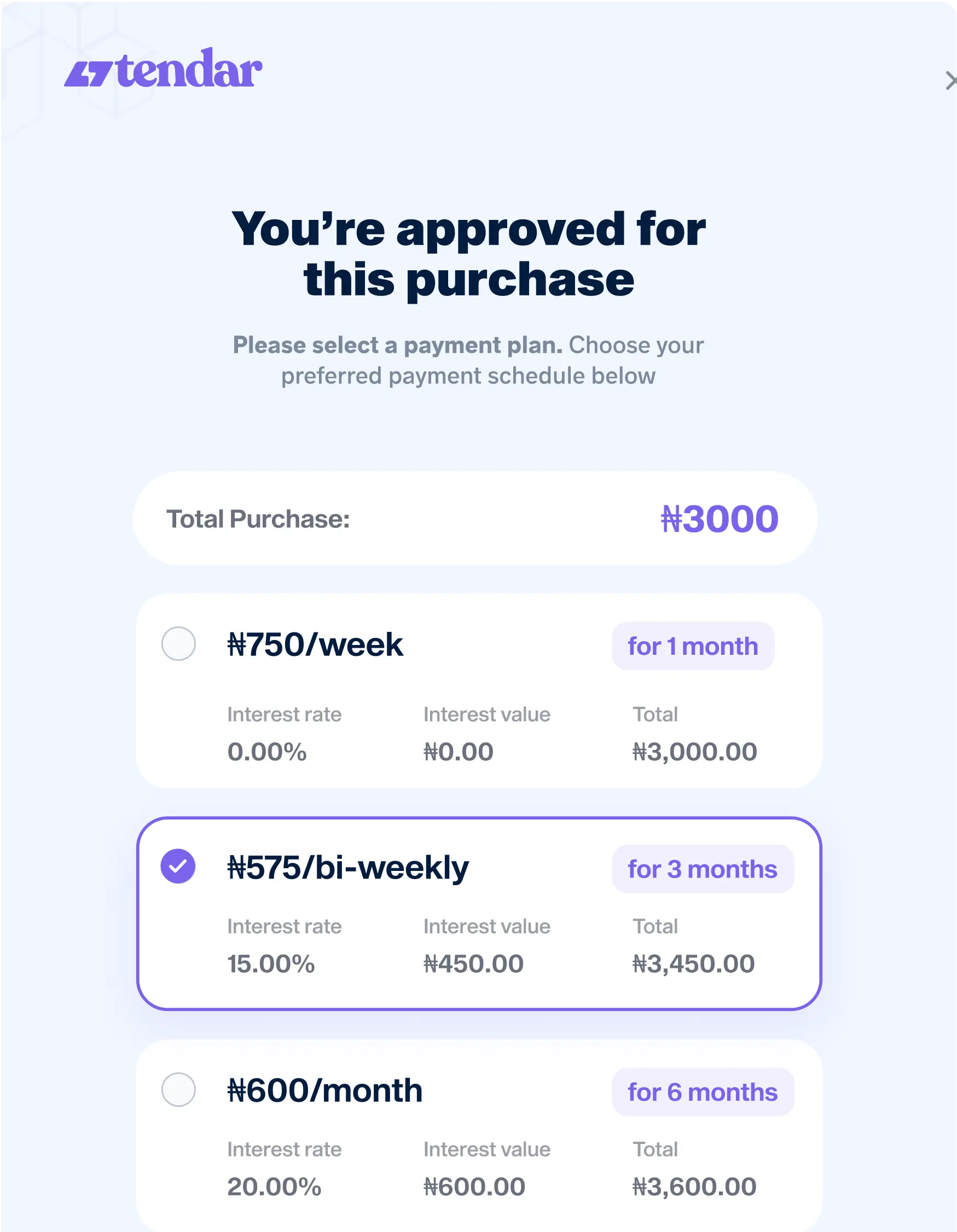

Customizable Checkout Experience.

Comprehensive Documentation

Lifecycle webhooks keep you up-to-date.

Enhance customer experience with pre-built modules for credit scoring, loan management and so much more. Grow your business without starting from scratch.

Empower your customers with flexible payment options using Tendar’s BNPL Product. Seamlessly integrate our advanced BNPL solution into your site or app, letting customers choose their payment method at checkout. Drive sales, boost loyalty, and simplify your checkout process.

Get Started

Our low-code service lets you launch your digital lending platform in one week with zero development time.

Get StartedWhat our customers are saying