Efficient Debt Resolution

Easily handle debts with Tendar's automated recovery tool. It makes debt management simple and ensures you get paid back on time.

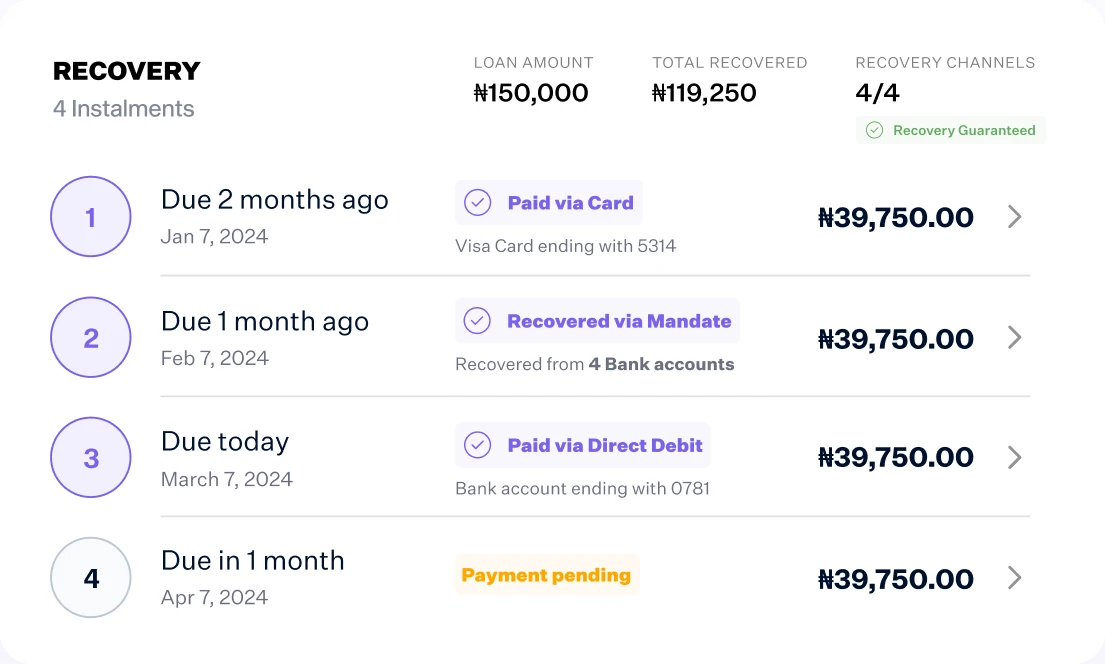

Recovery

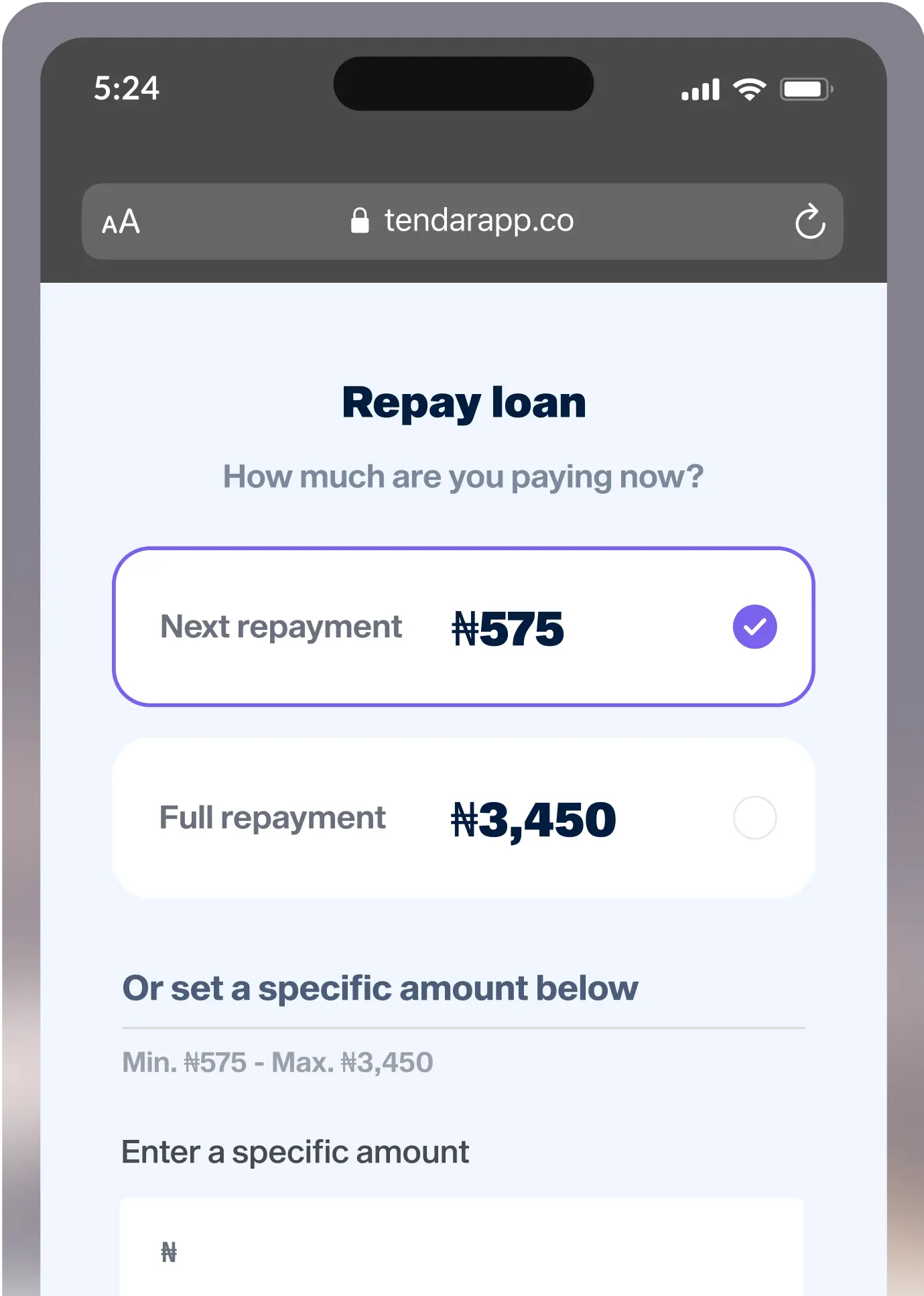

With Our Automated Recovery System, payments are deducted automatically on the due date, with reminders sent to ensure timely repayments.

Contact Sales

Tendar ensures timely loan repayments by automatically deducting payments on the due date, sending reminders and multiple direct debit options.

Easily handle debts with Tendar's automated recovery tool. It makes debt management simple and ensures you get paid back on time.

Use our data analytics to understand borrower habits, reducing defaults and improving collections.

Automate debt management with scheduled payments and proactive follow-ups to ensure timely resolution.

Integrate our next-gen credit engine into your product without any hiccups. Save time, cut costs, and launch solutions your customers will love.

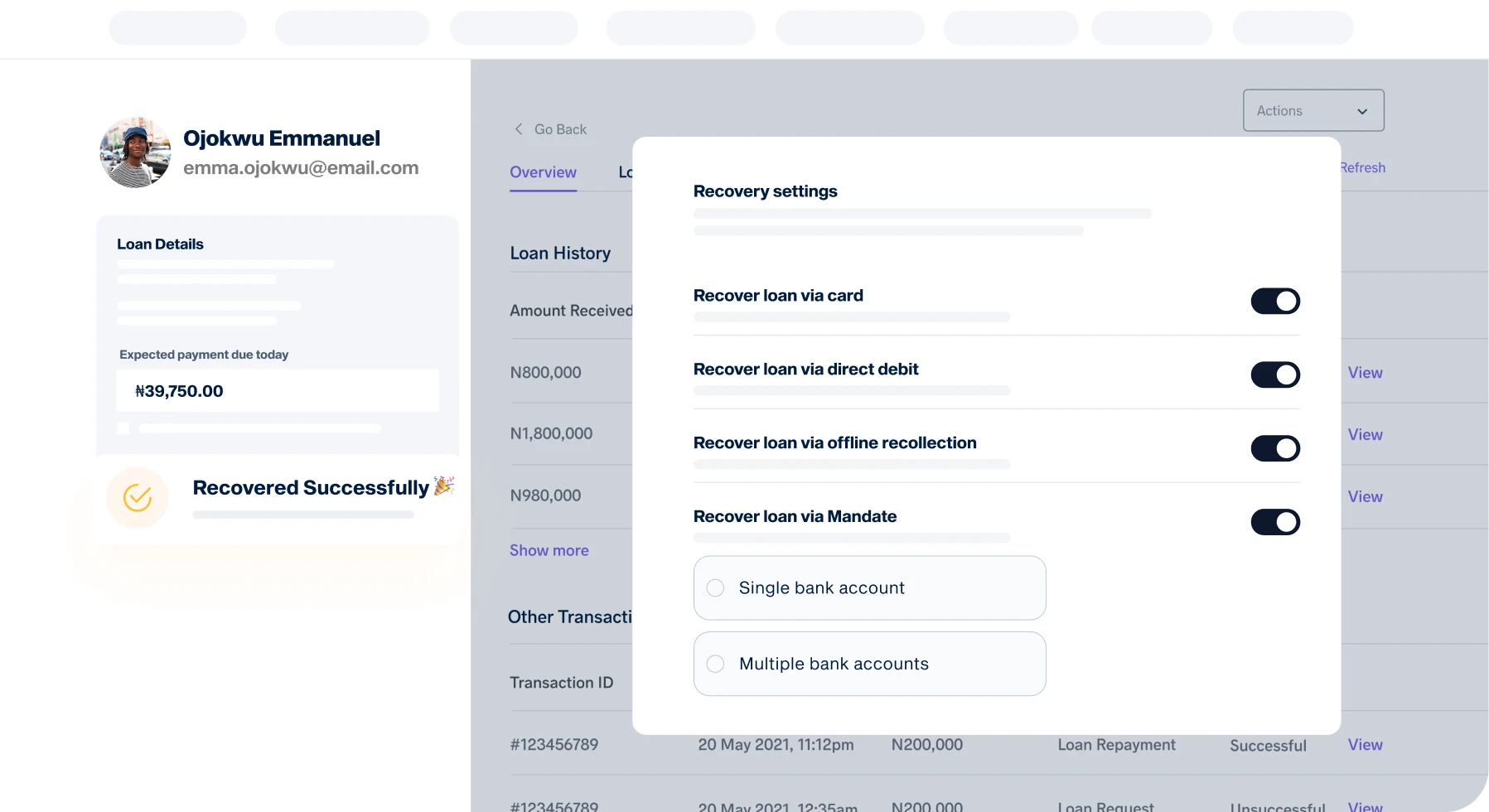

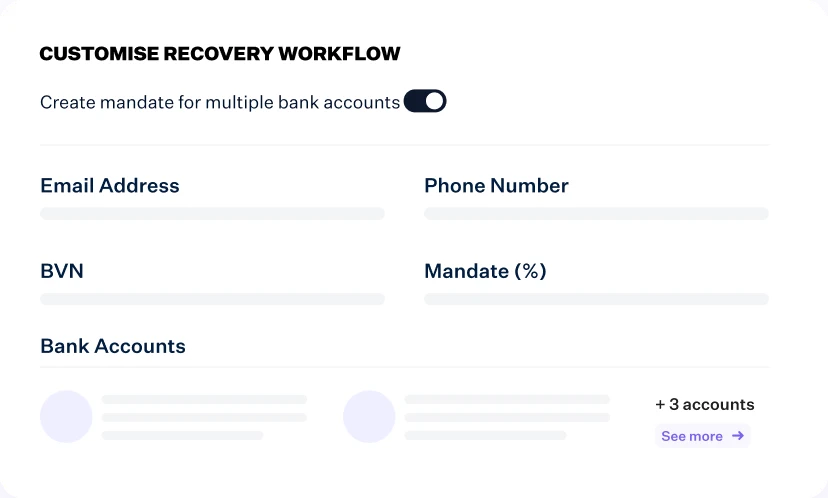

Get StartedYour comprehensive solution for business needs. Customize debt recovery with Tendar's tailored workflows to align with borrower payment history and default rates.

We collect loan payments via cards and bank account direct debits using secure gateways, ensuring safe processing. Lenders can monitor transactions and track fund flow seamlessly.

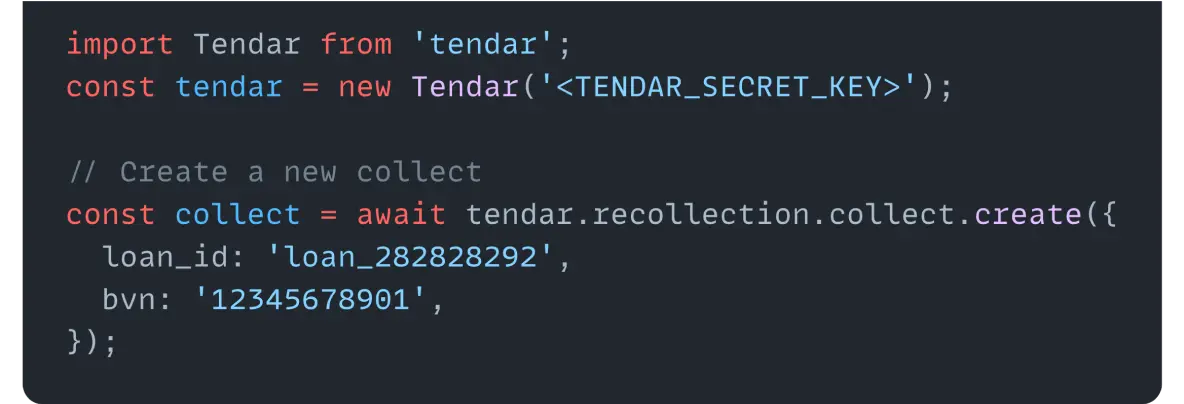

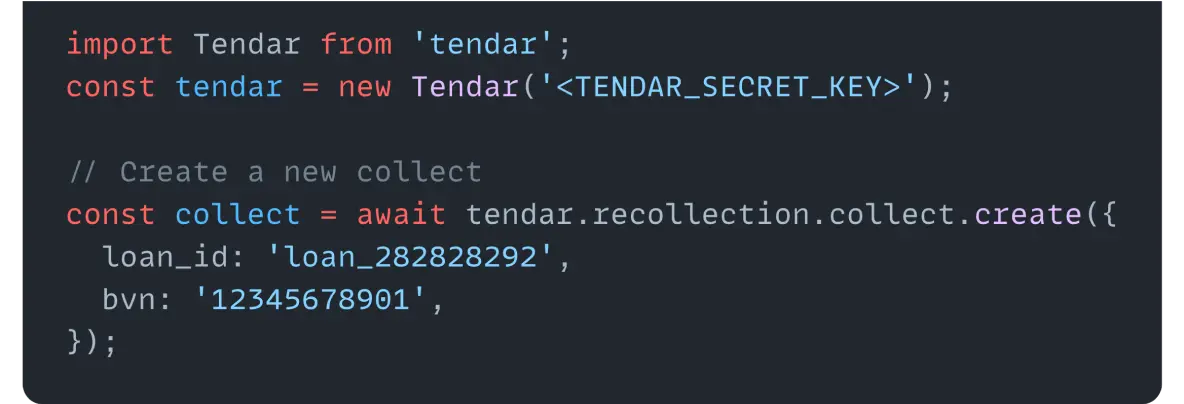

We pride ourselves on being developer-friendly, offering adaptable lending building blocks tailored for developers.

Scheduled Recollection

Real-time Notifications

Integration Flexibility

Lifecycle webhooks keep you up-to-date

Enhance customer experience with pre-built modules for credit scoring, loan management and so much more. Grow your business without starting from scratch.

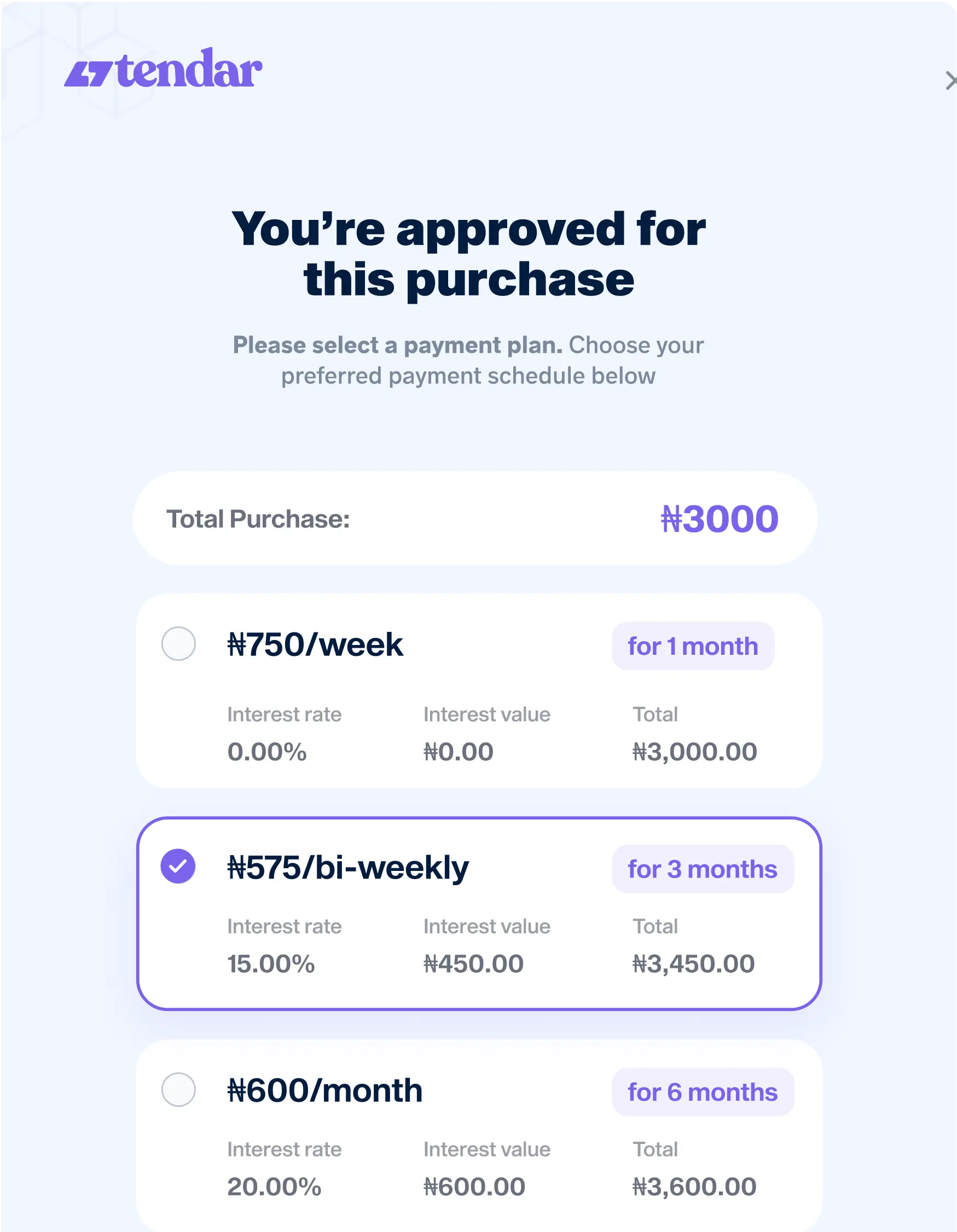

Empower your customers with flexible payment options using Tendar’s BNPL Product. Seamlessly integrate our advanced BNPL solution into your site or app, letting customers choose their payment method at checkout. Drive sales, boost loyalty, and simplify your checkout process.

Get Started

Our low-code service lets you launch your digital lending platform in one week with zero development time.

Get StartedWhat our customers are saying